That’s just Mitnick’s over-inflated ego and constant media presence. The punishment he received was not commensurate to his crimes, giving him reasonable support. Everything else is just his hype game.

- 0 Posts

- 50 Comments

63·1 month ago

63·1 month agoYou literally spent an entire comment explaining why you should not use scientific notation and now you’re asking why I might prefer precision in byte arithmetic?

Good luck with that.

73·1 month ago

73·1 month agoIf I ignore what’s in the search bar, I remember that the prefix “mebi” means 2^20 and use a calculator. Your point doesn’t make sense because you’re asking us to get mad at a tool intended to convert scientific units for using the bog standard scientific notation. Byte math uses powers of 2 ergo we should use a calculator that isn’t explicitly set up for rounding.

16·1 month ago

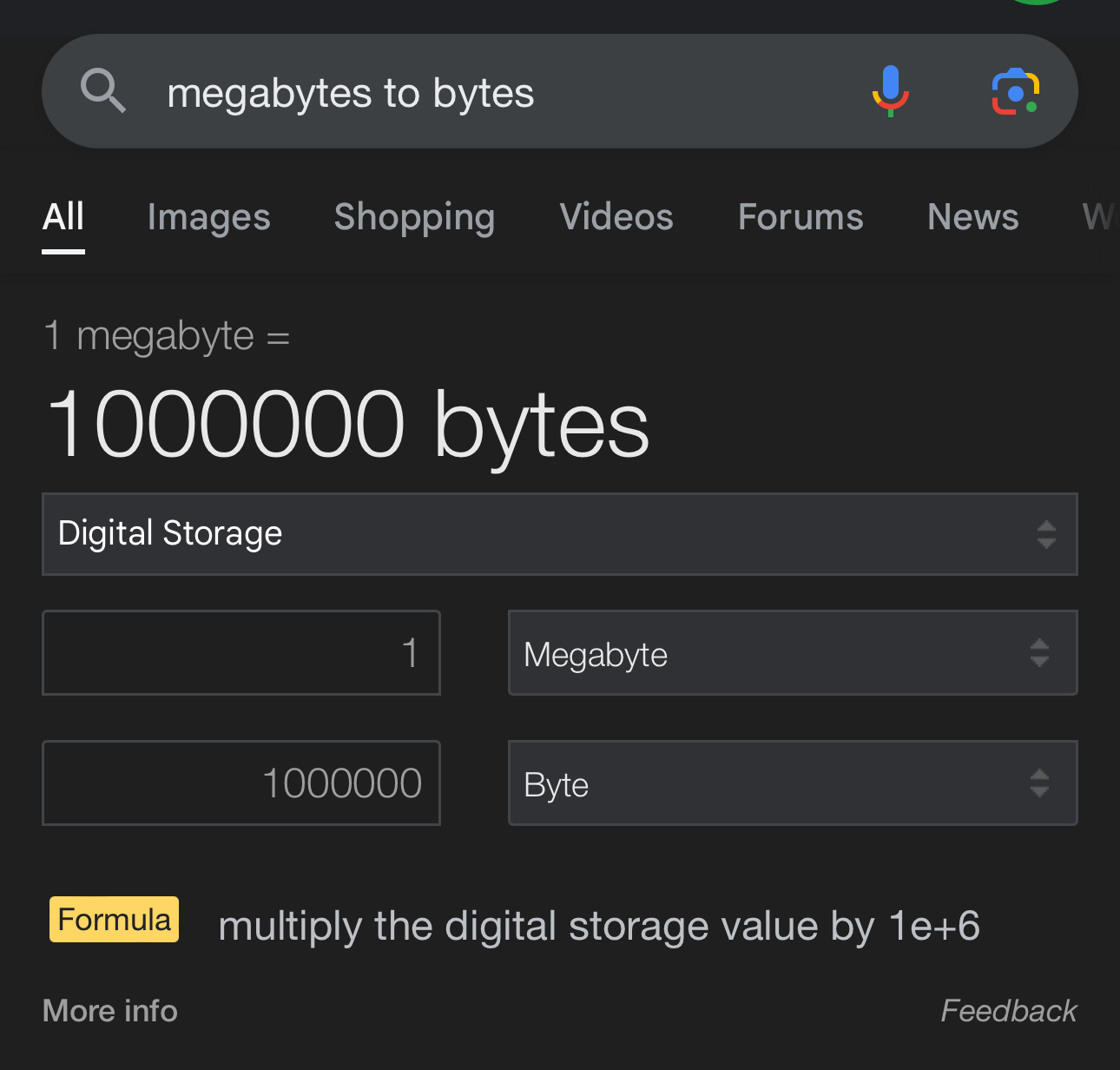

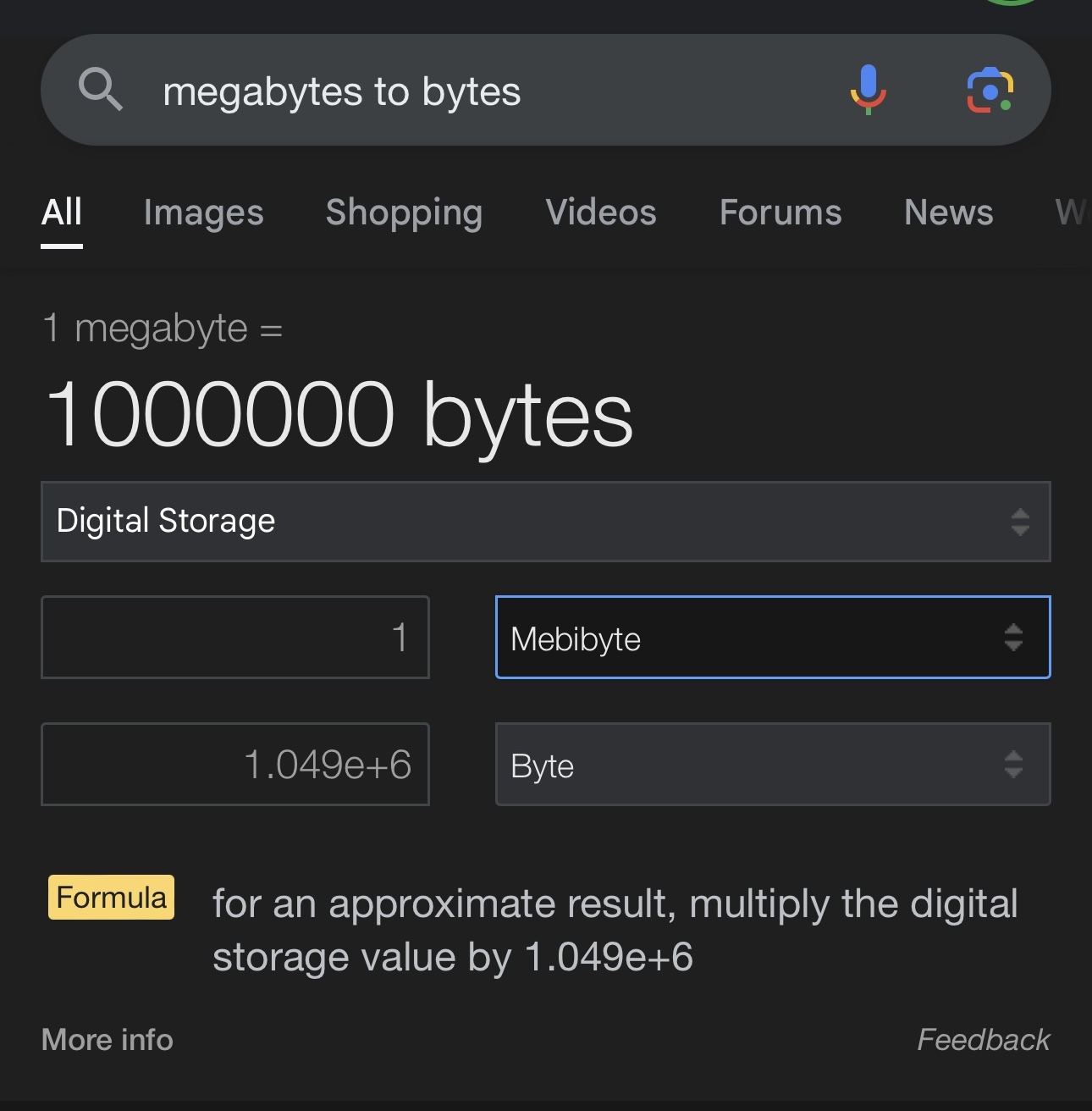

16·1 month agoWhen you search “megabytes to bytes” the units are correct and the number is one. If you edit the form, the number might not be one and the units might not be correct. Changing units highlights the unit input.

OP’s ostensible point posting on this community is that searching “megabytes to bytes” gave “mebibytes to bytes” in the calculator but OP’s image shows OP has changed the calculator.

611·1 month ago

611·1 month agoHere is what I get when I complete the search.

And here’s what I get when I intentionally change the units. Notice the color difference?

2·2 months ago

2·2 months agoDepends on how you use capitalism for alignment. If we view capitalism as necessary for alignment, this is probably lawful neutral if not lawful good. There’s honor in selling the right product and you’re not breaking any rules here. If we view capitalism as unnecessary or even evil, this is much more on the lawful evil side than chaotic. Again, it’s not breaking any rules and it follows a strong code of conduct. It’s hard to view a company that remains in business for any period of time as chaotic because you need a system to systematically take advantage of everything.

1·3 months ago

1·3 months agoSee my link for 47. Its Wikipedia has more context. If you’re a Star Trek fan, you’ve seen it a ton.

2·3 months ago

2·3 months ago42, 47, and 50 all make sense to me. What’s the significance of 37, 57, and 73?

16·3 months ago

16·3 months agoThey already did that. They companies the tools to remove negative reviews. Glassdoor has not been much different from BBB for some time (if not all time).

0·4 months ago

0·4 months agoMy stance has been that, just as long as I’m interviewing with someone, I’m happy to do it, up to an undetermined time threshold. A screening interview, a tech screen, and then a bunch of panels is what I expect from a solid firm. Just as long as I’m interviewing with someone, I have a lot of opportunities to learn myself. I will also occasionally do a take home if and only if there’s a novel problem I want to solve related to that take home (eg I want to learn a library related to the task) but this is very rare.

As a hiring manager, I try to keep things to a hiring screen, a tech screen, a team interview, and a culture interview. My team is small. I don’t want to spend more than three hours of someone’s time (partially because I can’t really afford to spend more than that myself per candidate or lose more team hours than that). My tech screens are related to the things I actually need people to do, not random problems you’ll never see.

My assumption is that a good dev has lots of opportunity and I am in competition with everywhere else. I need to present the best possible candidate experience. Big companies with shitty employee experience telegraph that by presenting a shitty candidate experience, which is where the employee experience begins. You can’t have a good customer focus without starting from a good employee focus.

1·5 months ago

1·5 months agoIt’s even more funny because there’s so much stuff that really doesn’t belong in museums if you talk to curators. The average person thinks a Picasso would go for millions and be on display anywhere; there are sketches Picasso did that only have value because Picasso drew them not because they’re good Picassos or moving art. This piece has a good perspective. If we hoarded everything ever we’d get to the point where future generations couldn’t make any new art because there would be no space.

I will never be able to actually touch one of these gems because no museum would let me. At the end of the day there’s not much difference between me flying across the world and standing in line with a bunch of people taking shitty selfies in front of a ton of protective glass to catch a glimpse of one side of this gem and seeing a virtual scan I can move around. Digitize it, send it back where it came from, and look toward new art.

You raise a really interesting question there. I always ignore Tether as a joke because it’s just a crock of shit. But what happens if someone makes a run on Tether? They publish accountability reporting which, crucially, tells consumers to inform themselves of the general risks and potential legal issues. It would appear that Tether does have ~80bil in USD assets of various maturity. Only ~400mil of that is cash. There’s another ~20bil in other assets. If there is a run on Tether, it collapses at under 1% of its balance, ie of the ~100bil in Tether only ~400mil/0.4bil of it could be converted to USD today (well, 2023-12-31 per the last report). Since it’s not insured, there’s nothing to prevent a run on it. Its value is supposed to be its ability to be converted to USD, so if a run occurs and people are not able to make the conversion, its value plummets and can only be rescued by the fire sale of assets well below market value. Tether, more so than fiat currency, has completely made up value.

I’m not a finance person so I bet someone that knows more than me has already done a better job of explaining how Tether is a scam.

I’m flabbergasted. I would have thought that your graphs that claimed to show no inflation yet clearly increased would have prepared you for irony.

Wow, it’s so amazing that the price of gold remains forever consistent. If we had a resource-backed currency inflation could never happen because we never adjust the cost of silver. Scarcity and psychology have no power here!

The Fed printed at most 200bil in 2023, down from 330bil in 2022. There’s about 2.25 trillion in circulation and about 15% of the notes are destroyed every year, which is loosely equivalent to the cash order the Fed created, give or take a couple of percent. Inflation for 2023 using the Consumer Price Index was about 3%. That means net cash supply didn’t really change much and prices went up.

If you think that ~200bil in cash has any effect on inflation I’ve got an amazing investment opportunity for you: it’s called crypto and it’s totally legit.

2·5 months ago

2·5 months agoWhen I create remote posting I put them in lots of markets. I only need one engineer; I just want to hit lots of hiring pools.

You can get this on a pin (not the seller; had problems with the seller so YMMV). The art itself is called “Flaisch Macht Flaisch.”

I am not surprised by either the author or the HN community completely missing it’s getting harder to die if and only if you can afford it or want to throw your family into crippling debt for the rest of their lives. This might be a US problem only. I rolled my eyes when the article opened with “sophisticated New Yorkers” and then completely ignored the cost all of this incurs.