The Mona Lisa is just a canvas with paint on it

You forgot the part that it is 500 years old and made by a significant historical figure.

And it’s got “This is a fake” written in felt-tip pen on the canvas.

So if an NFT was 500 years old and made by Obama then it would be the same?

Fine art is valued for taxation and insurance purposes

So I have news for about NFTs…

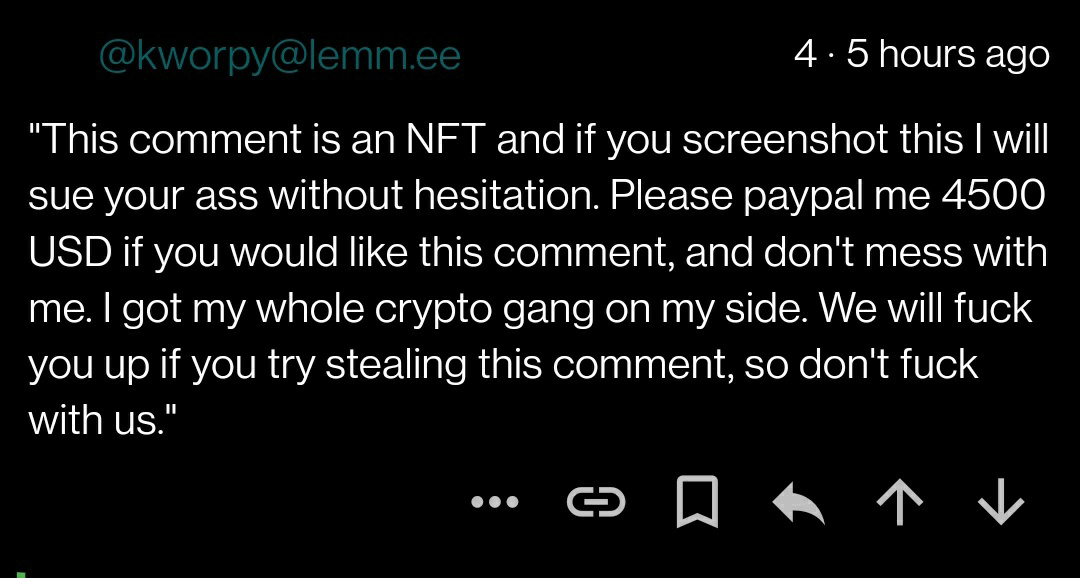

“This comment is an NFT and if you screenshot this I will sue your ass without hesitation. Please paypal me 4500 USD if you would like this comment, and don’t mess with me. I got my whole crypto gang on my side. We will fuck you up if you try stealing this comment, so don’t fuck with us.”

Oops

“This comment is an NFT and if you screenshot this I will sue your ass without hesitation. Please paypal me 4500 USD if you would like this comment, and don’t mess with me. I got my whole crypto gang on my side. We will fuck you up if you try stealing this comment, so don’t fuck with us.”

Why are they asking for fiat currency?

It’s not even the picture, it’s the promise you own a picture

Holding an NFT can give you ownership of an image. If you have a bored ape NFT you own some legal rights to the image.

That’s because of contract law, and IP law. A contract assigns the copyright to the holder of the NFT, and governments enforce legal contracts.

The only thing that gives NFTs any claim to value is the fact that a centralized authority can enforce it. The entire concept behind the decentralized leaderless authority of the blockchain is a myth.

Yeah you can own an NFT but you can own any image through a license agreement with the owner.

Yes… That’s the point of my comment.

“You own the image“ functionally doesn’t mean anything in the context of NFT’s because the image component in an NFT is not actually exchanging hands so there’s nothing to truly enforce here. It doesn’t grant exclusive rights and all that comes with it, it just gives them ownership rights - an artist can’t say the owner can’t use it for their own purposes. People can screenshot it, make memes of that, etc. and you have no legal recourse because you do not have exclusive rights to the actual work. They did nothing that violates your ownership. The NFT is you have a receipt that nobody can dispute that says “I own this receipt associated with this image and can use it as such.”

When I shoot video and give people a screener, I watermark it and have legal rights to the image/video content itself. They cannot duplicate it or use it in any fashion without risking legal action by me against them. NFT’s do not have that same protection. I can screenshot a bored ape image that someone “owns,” barely augment it, and mint a new NFT with no repercussions from the person who bought the original NFT. The original artist could come after me potentially because they have the actual exclusive rights to the creation, which again does not transfer with an NFT purchase.

In addition, you don’t even own the means to protect the receipt. If the blockchain goes down, your receipt is meaningless and you don’t even have exclusive rights to the image to sell or license out.

To give one more example: if I buy a video game, I have certain ownership rights associated with that disk. This is assuming physical copies of course. I can do whatever I want with that physical copy within the bounds of ownership of a distributed IP. I can snap it in half, I can back it up to a drive, etc. What I cannot do is make copies and distribute it because I have no rights to the IP, it has not been transferred to me with the purchase. The developer/publisher still has exclusivity, they control the IP. And if somebody else makes copies of my gave to be distributed, I have no legal recourse. This is really the key factor here. That law they’re breaking is not about my ownership, it’s about the game developer and publisher’s rights to the IP. They are the only ones who have legal recourse. NFTs, it’s the same way. The artist has all of the legal protections that come with IP ownership. Not the person who bought an NFT of the artwork.

TL;DR: NFT’s are buying receipts. They’re roughly as useful as “a certificate of authenticity“ they comes bundled with collectors items that were sold on infomercials in the 90s and 2000s. Except you don’t even get to store the certificate yourself, you’re dependent on somebody else

Imagine waving the receipt of your brand new TV you don’t have in your home around in public for prestige

It’s more like you have a receipt for a link of where to get the manual for the TV.

And the picture itself is just a randomly generated picture of a money or a picture of Donald Trump photoshopped into something from the first page of Google images.

Cryptobros incoming to tell us all the real-world problems blockchain’s going to solve any day now in 3… 2…

The point of blockchains is decentralization, and as Lemmy users we know that decentralized services are difficult to make popular, even if they’re an improvement over their competitors.

This^

My desire for drugs

I got 99 problems, but a blockchain solves none

Money is just small sheets of intricately designed paper or plastic. Imagine how easy it was to make counterfeits back in the days before all the technology came in

Yep. After the civil war, a full third of US money was counterfeit which is why the secret service was created.

I think NFT’s had some promise for stuff you actually have to own (not some ape pictures). Like a digital version for maybe an invitation or tickets or if done properly (by your countries government for example) maybe even for stuff like licenses (i.e. driving license, welding license etc.) Or identification (passport, id, etc.)

For government documents you need nothing but a plain old certificate to create a digital signature. If there is a single instance of trust (such as a government) there absolutely no point in using a blockchain.

Decentral NFTs for concert tickets would only make sense if you were looking for a solution to liberate the second market, i.e. people selling tickets to other people without involvement of the host of the concert. Such a model is neither beneficial for the hosts (as they wouldn’t benefit from the second market sales) nor the visitors (as the second market typically leads to even higher prices). If you meant a way to return/trade tickets on a platform controlled by the host / the original issuer of the tickets, then there’s again no need at all for crypto aside plain old, stupid certificates.

Even in single instances of trust there can be advantages to using blockchain for those applications:

- Decentralization can give you better uptime/availability of those documents. If the DMVs website or authentication service goes down, documents can still be authenticated since they and/or their signatures stored in a distributed manner. The internet can go down at your bar but if you have a recent copy of a chain, you can still verify somebody’s ID.

- It can make them easier to transfer between parties, and creates a digital “paper trail” which can conform to whatever requirements one might have. For example, you could easily require several parties to sign off any time the document is moved or assigned to a new person.

- You can use those documents and their signatures with smart contracts or other decentralized apps. For example, you could sign up for an account at a bank or a platform like eBay using your NFT’d digital ID and the bank could accept it would needing to manually verify if the id “looks fake” or if your blurry phone picture is going to cut it. They don’t have to call up the government and ask them to verify it or pay some third party to match your address against their database of known people, etc.

- Maybe you need better transparency in how many documents are issued and (potentially) to whom. Voting systems, for example, are a use case for this. It could be used for shareholder governance structures, etc.

- Blockchains can enforce rules which centralized entities can’t, which is important to consider. An example of how this is useful: imagine the government has a digital ID system and it’s run in a centralized fashion, which makes sense, because they are the issuing authority right? Now imagine that centralized system gets hacked and an attacker starts printing and authenticating a bunch of fake ID requests. In the time between when this attack happens and when somebody figures it out, which could be hours to days, banks and other entities could be relying on those fake documents and potentially lose millions. An example of a rule a blockchain can enforce is “this ID issuing authority cannot issue in a single day more than 10% above it’s daily average of issuances over a six month period”, limiting the scope of an attack. One may say “Well, but blockchain can be hacked too!” which is true, but it’s less likely because the software for these networks has thousands of eyes on it whereas there may only be a couple system admins approving changes to your state-run ID database. Open source software is more secure than proprietary for this reason. Additionally, a security flaw needs to effect 51% of the network which isn’t likely to happen when you have a diversity of software versions.

- Many smart contracts need ways to protect against sybil attacks (ie one person pretending to be multiple). Quadratic funding being used for charity fundraising is a perfect example. By using credentials issued on chain by centralized authorities, they can verify a person is not multiple people. Quadratic funding is an awesome way to fund public goods.

The downtime issue for identities is already solved with a government certificate and distributed certificate revocation list. As long as multiple independent parties are mirroring the government’s list, taking down the government servers would not affect identity verification. Certificate Transparency solves the CA compromise problem since you have a log of all issued certs.

There are some fringe benefits for blockchain but massive issues with normal human issues like:

-

Scams/theft: person has the wallet lost through scam or left, how do you invalidate the lost credentials or tickets.

-

Wallet loss: loss through any number of means: fire, incompetence, computer being destroyed, loss of account to cloud backup etc

-

Issuer need to invalidate: if tickets/credentials were purchased by fraud or an issue occurs where they need to invalidate

How does blockchain handle these common situations?

The government would obviously be in charge of the blockchain in a very strong way. You would do the exact same process you would to replace a stolen license.

Scams/theft: person has the wallet lost through scam or left, how do you invalidate the lost credentials or tickets.

In these examples, we are talking about credentials issued by a central authority. That authority can re-issue new credentials and invalidate old ones. Easy peasy.

If we’re talking about the risk that people have their crypto stolen in general, yes it does carry that risk same as cash. There are several strategies to mitigate this: people can park larger amounts at institutions if they want or they can use things like multi-sig wallets. You have one smaller pot of money which is your everyday spending wallet which you (or somebody who gains access to it) can spend from whenever you want, and one which is “multi-sig” meaning at least one of your trusted friends/family members/etc also has to sign off if money moves out of that account. You can have multiple people on the multi-sig wallet and set the rules for example 2 of 5 friends or what have you. You wouldn’t leave $10,000 in your phone’s mobile wallet just like you wouldn’t carry a briefcase with $10,000 in cash on the subway. Small money in your spending wallet, big money in your multi-sig.

This is similar to how one stores money normally. You have some cash in your wallet and you put the rest in a bank. In order to withdraw significant money from your bank account, the bank is going to undertake some kind of investigation to make sure it’s actually you. This might be checking your ID at the teller for example. They might also include some type of fraud guarantees where they will cover any losses you experience. That kind of a system is not incompatible with blockchain and I expect with time industries will appear to mitigate these kinds of risks from an insurance perspective.

Also, generally speaking, no system is going to completely eliminate theft and fraud. 99% of the fraud and theft committed over human history has been done using traditional currency, including the kinds of fraud that aren’t even called fraud because the “right people” are doing them like bank bailouts or market manipulation. Even highly-credentialed systems like Paypal are rife with fraud, ask any ebay seller. So we can’t expect crypto or any other technology to eliminate it either, there will always be some. The best we can do is try to find technological, social, and educational methods for reducing it.

Wallet loss: loss through any number of means: fire, incompetence, computer being destroyed, loss of account to cloud backup etc

Same risks as cash, multi-sig or institutional holdings as explained above can solve this.

Issuer need to invalidate: if tickets/credentials were purchased by fraud or an issue occurs where they need to invalidate

Same as answer 1

-

Every single one of the examples you gave relies on some single centralized authority to give it value. Passports and licences are meaningless without a government. Tickets rely on the venue.

I have not heard anyone mention any application for NFTs that would work better than a database run by the agency that is required to give the document value.

Blockchain is a solution in search of a problem.

The problem IS the centralized authority. Can you forever trust a government to not artificially inflate or deflate the value of a currency? The whole point was to have a system with no single authority. No single point of failure.

It is, however, not perfect. The volatility, limited number of transacrions per second , and reliance on an incredible amount of energy expense were the largest of these when the original bitcoin concept was created. Some of these issues have solutions, but its still an evolving technology.

NFTs are just USED for pictures. They actually had potential to solve real world problems, but jetzt isch d Katz de Bååm nuff as we say in hohenlohe.

Came here to say this. It’s a silly way to look at it, but these dorks are basically saying “no, using the ‘internet’ is not going to catch on silly techies.” It’s a kind of technology, not a vehicle specific to capitalism or big funds. NFTs could be proof of ownership over anything.

Consumers want true ownership, even if it requires a kind of tokenized-receipts system.

We’ve had gpg signatures for ages. No block chain needed.

can these be held and traded in a verifiable way?

Bold statement.

I would argue that just because something that could work doesn’t mean it is the best fit for the job for one reason or another.

We have multiple programming languages, database, filesystem, media formats etc…etc… Those also generally perform the same thing but some do certain things better and you pick whatever one best fits your needs.

why can block chain and go both existing and fit whatever role best fits them?

Not saying block chain / NFTs are the answer to ownership tracking just saying we shouldn’t write them off just because something else might work.

NFTs

Note: this is how you spell it. Apostrophes are for possession & contraction …not making words plural.

That’s not true. Apostrophes can be used to make acronyms plural, and there are cases where not doing so is clearly wrong (e.g. Oakland A’s)

No style guide says this. The only exception I have ever seen is single letters, and even that is up to interpretation.

That’s not true, clearly an apostrophe means: “watch out, here comes an s!”

Correction:

That’s not true, clearly an apo’strophe mean’s: “watch out, here come’s an 's!”

You forgot /'s

What about for the Goa’uld?

FWIW nobody who is actually knowledgeable about crypto ever thought anything positive about NFTs. It’s all just wallstreetbets types who read one article and think they’re economists now. The tech is interesting and has applications but monkey jpegs are what idiots spent millions on for some reason.

The tech is interesting and has applications

I used to say that, but I’ve given up on that idea. I’ve never seen a use of blockchain yet that didn’t boil down to being virtual money. NFTs could have had potential as a method of trade if they were tied to real ownership of things instead of just receipts saying you bought a cartoon monkey jpeg.

But every time I think something would be a problem blockchain solves, I can always think of an existing, typically better, solution to that same problem. I think that space is too infested with grifters to attract anyone with a truly novel idea.

You’re getting downvoted by cryptobros, but you are absolutely correct, there is no good use for block chain and never will be

It’s a fully public database among trustless parties. To the first point, there’s no reason any database can’t be made public if so desired. To the second point, for the block chain to have any meaning or value beyond itself, some authority eventually needs to interpret its contents. That authority might as well hold the database or, in trustless cases, a third party trustee. Nothing about it makes sense at a very base level, you don’t even need to explain the tech because it just doesn’t hold up logically.

I’ve never seen a use of blockchain yet that didn’t boil down to being virtual money.

A classic bitcoin article agrees with you: It’s Not About the Technology, It’s About the Money

People who are knowledgeable about crypto spent real money on a thing called dogecoin.

I think the entire boom it had was from regular people, people who specifically weren’t knowledgeable about crypto.

Exactly. Same with NFTs

The same will happen any time a “get rich quick” scheme comes around. People saw things going up 100% in price from one day to the next, compared to a 2% per year savings account. That’s very enticing for anyone.

This one was at an impressive scale though. Probably because it was so accessible. I’d have my BIL in South America telling me he’s playing a game that mines some random coin. Can’t really say much other than to be sceptical and never risk more than you can afford to lose.

People saw things going up 100% in price from one day to the next, compared to a 2% per year savings account. That’s very enticing for anyone.

And that’s the entire problem…by the time things go up in price by 100%, the people that will make money have already made it. Getting in at that point is useless, and will likely lose money.

Nobody who is knowledgeable about crypto ever thought dogecoin was anything but a meme coin or pump and dump scheme. They would have known it offered zero benefits technologically over existing cryptos. Some may have bought it to cash in on the crazy market surrounding it, but they never thought doge was the future or anything. The people who thought that were the “i read one article and I’m a crypto expert now” crowd referenced in my original comment.

I viewed it as more of a donation to see the stupid meme on Nascar or other dumb sponsorships.

I was pretty shocked when I found out that NFT pictures aren’t even stored in the block chain. NFTs are just records on the block chain with links to images stored on ordinary servers.

There are now Bitcoin Ordinals, which are similar to NFTs but with a sufficient size limit to actually store the media itself.

I’m pretty sure you could always store a full image in an NFT on ethereum, it’d just cost stupid high transaction fees.

Interesting, but the scarcity this is trying to manufacture still doesn’t apply to the image itself which can be easily and endlessly copied.

This is because you (in theory) need the whole blockchain to validate an NFT, so you want to keep it as small as possible.

But since you store the Cryptographic Hash of the image too, you can validate that the image on the server is actually the same one referenced by the blockchain. You could even move it to another server, but it will break the link obviously

Except you don’t own that server and have no control over it, and if the server owner takes the image offline you’re screwed

It does not really matter. You’ve still got the JPEG (or whatever else). Just calculate the hash and you can proof that it’s the one referenced.

No they aren’t NFTs are recipts. That is all they are. They can have a connection to images or physical goods but they only proove that you bought a recipt and not actual ownership.

so a deed to a house only proves that you bought a piece of paper, right?

Sort of except it means nothing. It’s like having a deed with absolutely no legal weight.

If I buy a microwave and try and return it with only the receipt they won’t give me a refund because I only bought the receipt. I could sell the receipt, sure it says you bought it but I am keeping the microwave.

If the deed was scribbled with crayons by a hobo and the house would be imaginary. That would be comparable to NFTs.

No a deed to a house has legal meaning. So it’s not at all like a deed to a house.

I personally view crypto and the crypto boom as an experiment in unfettered capitalism - it’s still a new technology, the governments haven’t caught up to it yet so no regulations, yet quite literally 99% of crypto usage was in trying to take advantage of others (scams) and speculation.

The only thing with actual value that came out of crypto was probably Monero, which allowed for completely anonymous payments, something that crypto, when paired with crypto exchanges, is bad at.

Onion routing (like Tor) is the default for the Lightning Network. Every crypto that supports it already has private payments, including Bitcoin.

There’s no way to validate the total supply of Monero. So if it ever has a supply bug (like Bitcoin’s value overflow incident), then it won’t be detected and patched.

Monero has mechanisms for validating supply:

https://m.youtube.com/watch?v=vW9H6VIONWM&t=174s

If you’re going to repeat this argument ad nauseam then at least don’t do it in a misleading absolutist way.

I don’t 100% disagree with him. Like he said, it is an additional risk. Assuming no supply bugs, you can validate what is published.

I just disagree with him that it’s “near zero probability”. This already did happen with Bitcoin and we only caught it because we weren’t assuming zero supply bugs. Bugs happen and we’re talking about the future money supply for all humans.

Edit to add: and BTW it’s not just cryptography bugs (rare), but anything related to validation (like value overflow)

Here is an alternative Piped link(s):

https://m.piped.video/watch?v=vW9H6VIONWM&t=174s

Piped is a privacy-respecting open-source alternative frontend to YouTube.

I’m open-source; check me out at GitHub.

Maybe I’m not very knowledgable, but even Monero seems sketchy to me. I’ve clicked into what I thought were blogs about privacy that ended up being sites that exist only to promote Monero, once you look into them. That and the way certain accounts will do nothing but praise Monero just seems very greasy to me. I also wonder how it solves some of the other problems inherent to crypto, such as the environmental concerns.

For things like drugs like the person mentioned below, I don’t think I’d trust someone who didn’t just use cash.

That being if you can get yourself some Monero anonymously. I can see valid use cases for that, for example in the drug busines…

The level of the NFT craze was kind of wild though. I remember watching this Hot Ones interview with Mila Kunis where she mentioned “connecting with the audience through NFTs” and “the audience owns the art to the show”.

https://youtu.be/NAeOzDhL6tc?t=1m55s

At the time I remember thinking that I don’t really understand how that would work in practice or what value NFTs really bring to this situation. I just assumed I didn’t understand. Turns out…nobody did. It’s just a bunch of bullshit.

Here is an alternative Piped link(s):

https://piped.video/NAeOzDhL6tc?si=it3vFINprPvt8ExV?t=115s

Piped is a privacy-respecting open-source alternative frontend to YouTube.

I’m open-source; check me out at GitHub.

I think it defies the concept of property in its core.

NFT’S

Stay in school, kids.

Actually NFTs aren’t even pictures xD

Imagine buying a hyperlink 😭

Hey, domain names are a thing you know

Hey at least then you own a domain name and all of its subdomains and can make them point whatever you want and host whatever you want out of them. When you buy an NFT you own one URL on an image hosting site, whose content you don’t even control.

That’s more of an address book provided by DNS.

Nope! Not even that. Just an agreement between the scam arti- sorry, seller and the dumbfuc- sorry, buyer, that the rights to something have changed hands. Nothing more, nothing less.

Physical money is just metal, plastic and paper.

The problem is the virtual value we give certain things.